Bitcoin edged lower on Wednesday, slipping 0.29% to $83,380 as bulls and bears battled for control. The decline follows a tug-of-war in sentiment—on one end, growing institutional adoption; on the other, discreet sell-offs from a major government holder.

Brazilian fintech firm Meliuz made headlines after confirming its intention to add Bitcoin to its corporate treasury strategy. The company already holds 45 BTC—worth around $4.1 million—and plans to expand its exposure using operating income and future partnerships. A shareholder vote on May 6 will determine whether BTC will officially become a long-term reserve asset.

The announcement sent CASH3 shares soaring 14% on the day and up 27% over five days, sparking optimism across Latin America’s corporate crypto landscape.

Meliuz’s Bitcoin Bet Highlights:

- Acquired 45 BTC in March using 10% of reserves

- Shareholders vote May 6 on expanding BTC exposure

- CASH3 stock up 27% in one week

If approved, this would mark another major step for institutional Bitcoin adoption—mirroring MicroStrategy’s playbook but in the LATAM region. Public companies added over 95,000 BTC in Q1 2025, bringing total holdings to 688,000 BTC globally.

Ripple CEO Sees Bitcoin at $200K, Offers XRP for SEC Settlement

Meanwhile, Ripple CEO Brad Garlinghouse boosted market confidence with a bold call: Bitcoin could hit $200,000 if regulatory reforms continue to unlock institutional interest.

In an interview with Fox Business, Garlinghouse revealed Ripple may settle its SEC case using XRP, with a revised $50 million fine (down from $125 million), to be paid in Ripple’s native token.

He emphasized that regulatory tides are shifting in the U.S., paving the way for wider crypto legitimacy and encouraging innovation. For investors, this signals a potential breakout moment for digital assets.

Highlights:

- Ripple proposes using XRP to settle a $50M SEC penalty

- Garlinghouse sees $200K BTC potential

- Institutional interest is climbing again

China Quietly Sells BTC as Economic Pressure Mounts

While Brazil buys, China is reportedly selling. According to Reuters, multiple Chinese municipalities are offloading around 15,000 BTC (worth $1.4B) through offshore exchanges. These assets were originally seized in past criminal investigations and are now being liquidated to counter domestic economic slowdowns.

Despite a nationwide ban on crypto trading, local governments appear to be tapping into BTC reserves to generate liquidity—a move that may test legal boundaries and regulatory tolerance.

What You Need to Know:

- China holds ~194,000 BTC (second only to the U.S.)

- 15,000 BTC currently being offloaded

- Sales could apply short-term pressure to BTC price

While this selling might cap near-term gains, it also reflects Bitcoin’s emerging role as a strategic reserve asset—even in highly regulated jurisdictions

BTC/USD Technical View: Momentum Weakens Below $84K

From a charting perspective, Bitcoin has broken below its ascending channel and the 50-period EMA at $84,020. Currently trading near $83,460, BTC is testing short-term support zones.

- RSI: 38.5 – bearish momentum building

- Key Support: $82,488 and $81,354

- Immediate Resistance: $84,020

Trade Setup:

- Entry: Short below $83,300 (after confirmation)

- Target: $82,500 → $81,350

- Stop Loss: $84,300

Pro Tip: Wait for a candle close below $83,300 with strong volume before entering. Premature shorts can get trapped in false breakdowns.

Final Thoughts

Bitcoin’s price action reflects a battle of opposing forces: bullish tailwinds from institutional adoption, and bearish headwinds from state-level sell-offs and regulatory uncertainty.

With Ripple’s settlement strategy and Meliuz’s treasury move in play, the long-term trend remains constructive—but traders should stay cautious until the dust settles around $83K support.

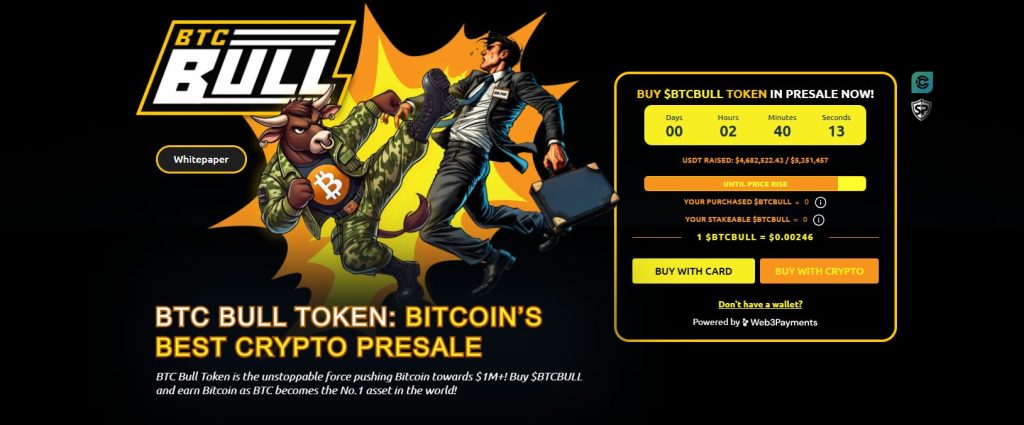

BTC Bull Presale: Earn Real Bitcoin with Every Price Milestone

BTC Bull ($BTCBULL) is gaining traction as one of the most exciting presales in crypto, combining meme culture with real utility. Designed for long-term holders, the token automatically rewards investors with real Bitcoin as BTC reaches major price thresholds—aligning community incentives with Bitcoin’s growth.

Staking for Passive Bitcoin Income

BTC Bull offers a lucrative staking program boasting a 119% APY, allowing users to earn passive income while supporting the network. With over 882.5 million BTCBULL tokens already staked, community engagement continues to grow.

Latest Presale Updates:

- Current Token Price: $0.00246 per BTCBULL

- Raised So Far: $4.6M of $5.3M target

With limited time remaining and demand accelerating, this is a key window to secure BTCBULL at presale rates before the next price jump.

The post Bitcoin Drops to $83,000 — China Sells, Meliuz Stacks 45 Coins appeared first on Cryptonews.

Brazilian listed company Méliuz buys 45.7

Brazilian listed company Méliuz buys 45.7

Local governments in China are using private firms to sell crypto for cash to fund public budgets.

Local governments in China are using private firms to sell crypto for cash to fund public budgets.